Unclaimed property, whether it’s a forgotten bank account, uncashed check, or a life insurance payout, could be waiting for you or your loved ones with the California State Controller’s Office (CA SCO). However, in order to successfully claim this property, you’ll need to provide the right documentation to prove your ownership. If the owner has passed away, additional documents will be necessary to confirm the legal right of the heirs or executors to claim the assets.

In this blog post, we’ll provide clear, step-by-step guidance to help you gather the correct documents, navigate the claims process, and recover unclaimed property from the CA SCO.

Step 1: The Basic Identification Requirements

Whether you’re claiming property for yourself or on behalf of a deceased relative, certain basic identification documents must be provided for the claim to be approved. These documents verify your identity and legal entitlement to the unclaimed assets.

Here are the three essential items that must be included with every claim:

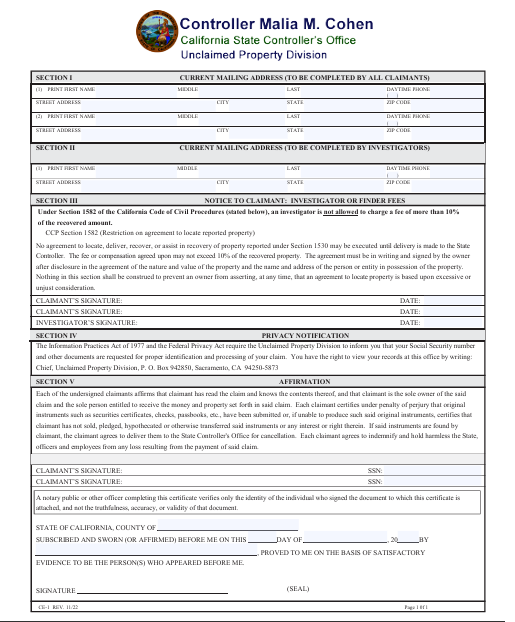

- State Controller’s Claim Form

The first and most important document is the official **State Controller’s Claim Form**. This form can be downloaded directly from the [California State Controller’s website](https://www.sco.ca.gov/upd_claiming.html). Be sure to fill out the form completely and accurately to avoid delays in processing. The form will ask for your name, contact information, and details about the unclaimed property you’re seeking to recover. - Proof of Identity

You’ll need to submit a clear copy of one of the following government-issued identification documents:

A valid driver’s license

A Department of Motor Vehicles (DMV) identification card

A passport

This step ensures that the person filing the claim is indeed who they say they are. - Social Security or Federal Tax Identification Number

In addition to the claim form and your ID, you must provide documentation verifying your Social Security Number (SSN) or Federal Tax Identification Number (TIN). This could include:

A social security card

A recent tax return with your SSN visible

For open estates, provide the estate’s federal tax identification number.

This basic identification is required for all claim types, whether you’re the original owner or an heir.

Step 2: Additional Documentation for Deceased Owners

If the original owner of the unclaimed property has passed away, you’ll need to submit additional documentation to prove your legal right to the assets as an heir, executor, or next of kin. This process can be more complex, but it’s necessary to establish that the property should be transferred to you.

Along with the basic identification items mentioned above, one or more of the following documents will be required:

- Birth Certificate of the Account Owner and Heir(s)

If you are claiming property on behalf of a deceased relative, you’ll need to submit both the birth certificate of the original owner and your own birth certificate. This helps establish your familial relationship to the owner of the unclaimed property. - Death Certificate of the Account Owner and Heir(s)

A certified copy of the death certificate for the original property owner is required. If multiple heirs are involved, you may also need to provide the death certificates of any heirs who have passed away. This document confirms that the original owner is deceased, allowing the claim to proceed under the heir’s name. - Marriage Certificate of the Account Owner and Heir(s)

In some cases, the marriage certificate of the account owner or their heirs may be necessary. For example, if the original property owner was married, their spouse may have legal rights to the property. Similarly, if the heir’s last name has changed due to marriage, a marriage certificate will help clarify the relationship.

These additional documents ensure that the property is being claimed by the appropriate person(s) following the original owner’s death.

Step 3: Property-Specific Documentation

Different types of unclaimed property may require additional documentation beyond the basic identification items and certificates listed above. The type of documentation needed will depend on the nature of the unclaimed property. Let’s take a closer look at what’s required for some common types of unclaimed assets:

Bank Accounts If you’re claiming unclaimed property from a bank account, here’s what you need to provide:

Account Statements: Provide a bank statement showing ownership of the account. This could be an older statement from when the account was still active.

Proof of Occupancy: If you do not have access to account statements, you may be required to provide proof of residence or occupancy at the address on record with the account. This can include utility bills, lease agreements, or other documents showing that you lived at the address tied to the account

Step 4: Submitting Your Claim

Once you’ve gathered all of the necessary documentation, you’re ready to submit your claim. Here’s a step-by-step guide for how to file your claim:

Filing Your Claim Online

- Visit the CA SCO Website: Go to the [California State Controller’s Office Unclaimed Property webpage](https://www.sco.ca.gov/upd_claiming.html).

- Search for Your Property: Use the search tool to see if there is unclaimed property under your name or your deceased relative’s name.

- Generate the Claim Form: Once you find the unclaimed property, you can generate a claim form online. This will include instructions for submitting your documentation electronically.

- Submit Supporting Documentation: Upload your identification documents, certificates, and any property-specific documentation through the secure portal.

Filing by Mail

If you prefer to submit your claim by mail, follow these steps:

- Complete the Claim Form: Download the claim form from the CA SCO website.

- Attach Documentation: Include copies of your ID, Social Security verification, birth certificates, and any other required documentation.

- Mail Your Claim: Send the completed form and documents to:

State Controller’s Office

Unclaimed Property Division

P.O. Box 942850

Sacramento, CA 94250-5873

Step 5: What Happens Next?

After submitting your claim, the CA SCO will review your documents and verify your eligibility to receive the unclaimed property. The processing time can vary, but it generally takes a few weeks to sevveral months, depending on the complexity of the claim.

If any additional information is required, the CA SCO will contact you, so it’s important to provide accurate contact details. Once your claim is approved, the unclaimed property will be released to you, either in the form of a check or the physical return of property, such as the contents of a safe deposit box.

Final Thoughts: Be Prepared and Claim What’s Rightfully Yours

Reclaiming unclaimed property in California can be a straightforward process if you have the right documentation. By following these steps, you’ll ensure that your claim is processed as quickly and efficiently as possible.

Whether you’re recovering unclaimed funds for yourself or on behalf of a loved one, don’t delay in taking action. Gather the necessary documents and start the claims process today—you might be surprised by what you find waiting for you!

You can also get in touch with MuleOne, and we’ll take care of your claim process from beginning to end with no upfront cost. The CA SCO will disburse the claim check directly to you.

Comments are closed